Articles

We've taken great care to create over 300 articles that cover how to set up, configure, and solve problems with our plugins for Magento and Shopware. This knowledge base applies to our plugins and the Shopware and/or Magento platforms too.

Magento 2 General Articles

Magento 2 Plugin Articles

ABN Achteraf betalen

Alternate Hreflang Tags

Beslist Winkelwagen Connect

Channable Connect

Datatrics

Digitec Galaxus

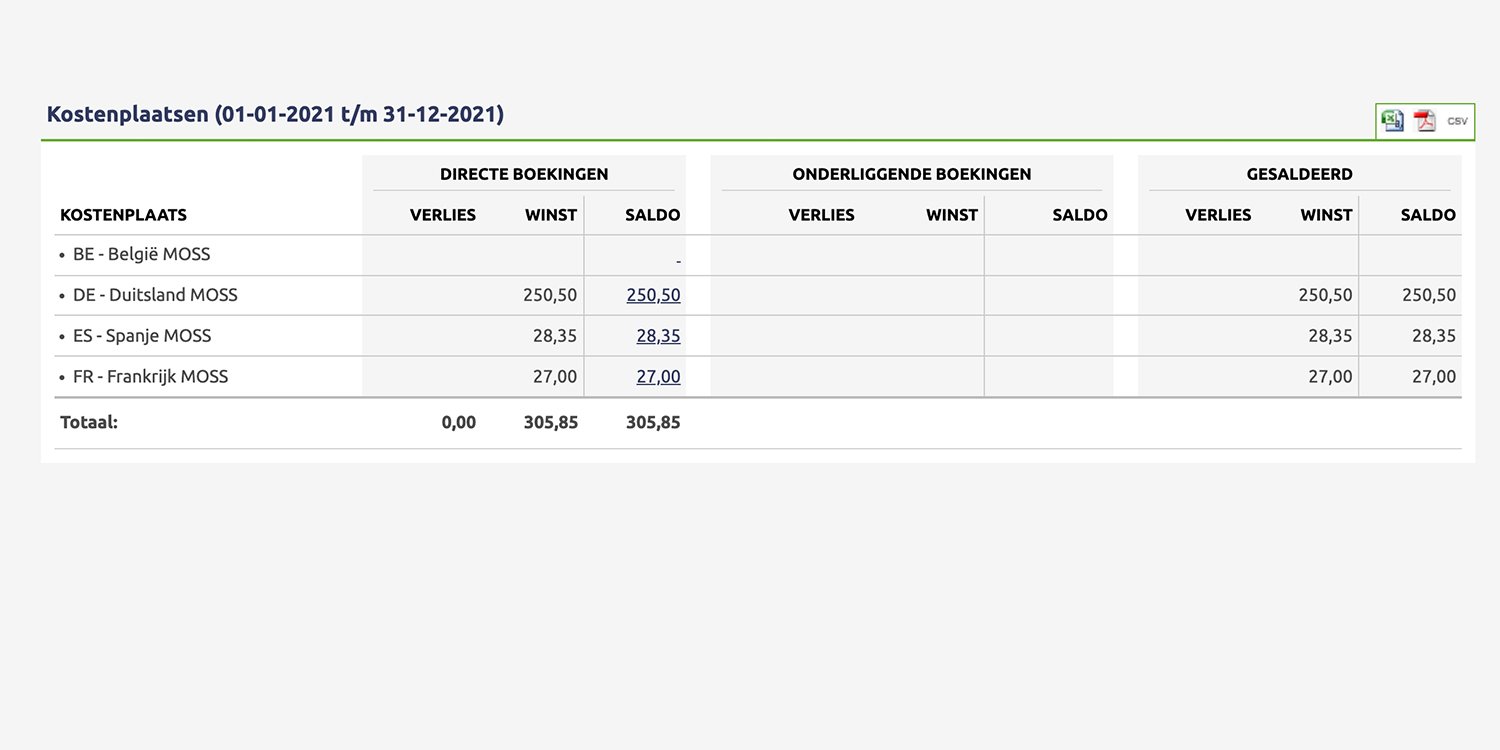

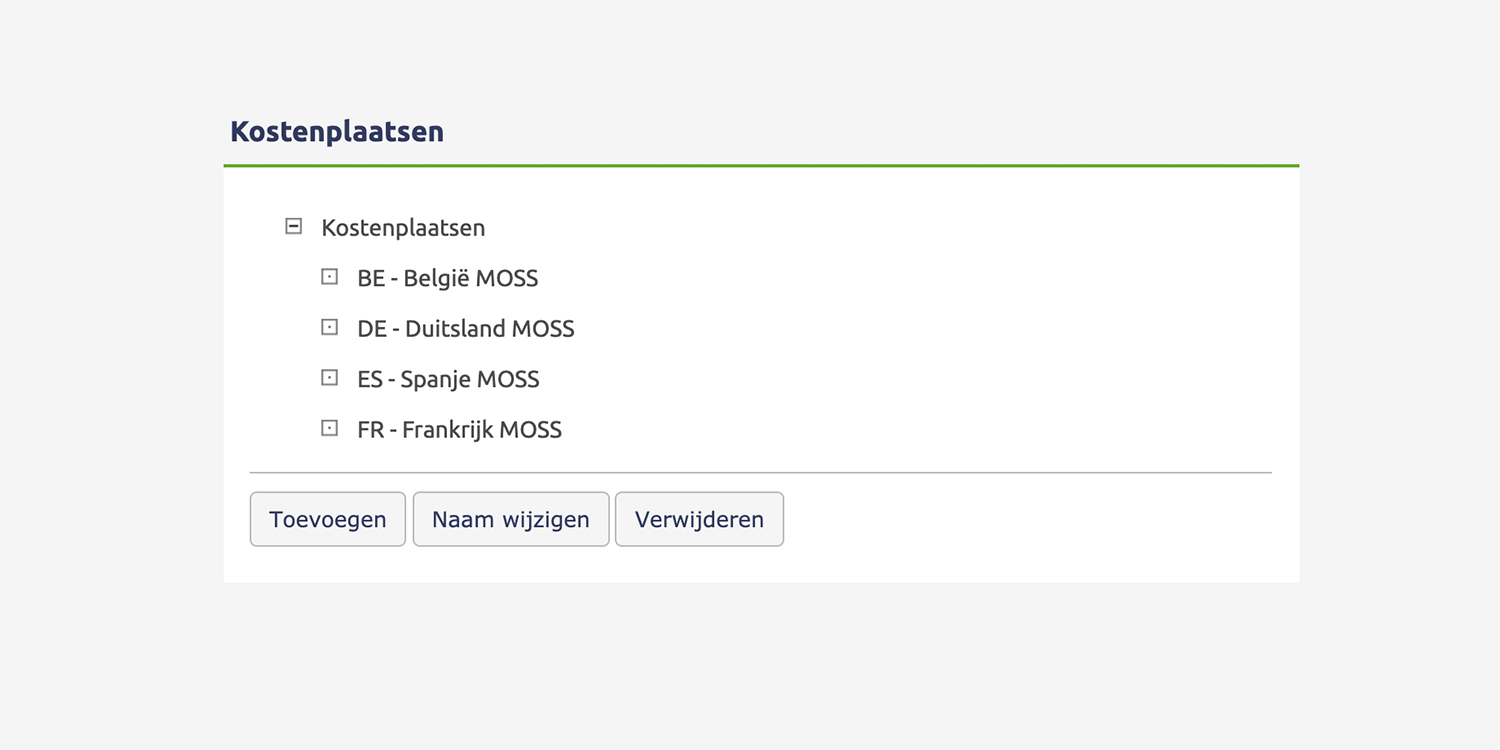

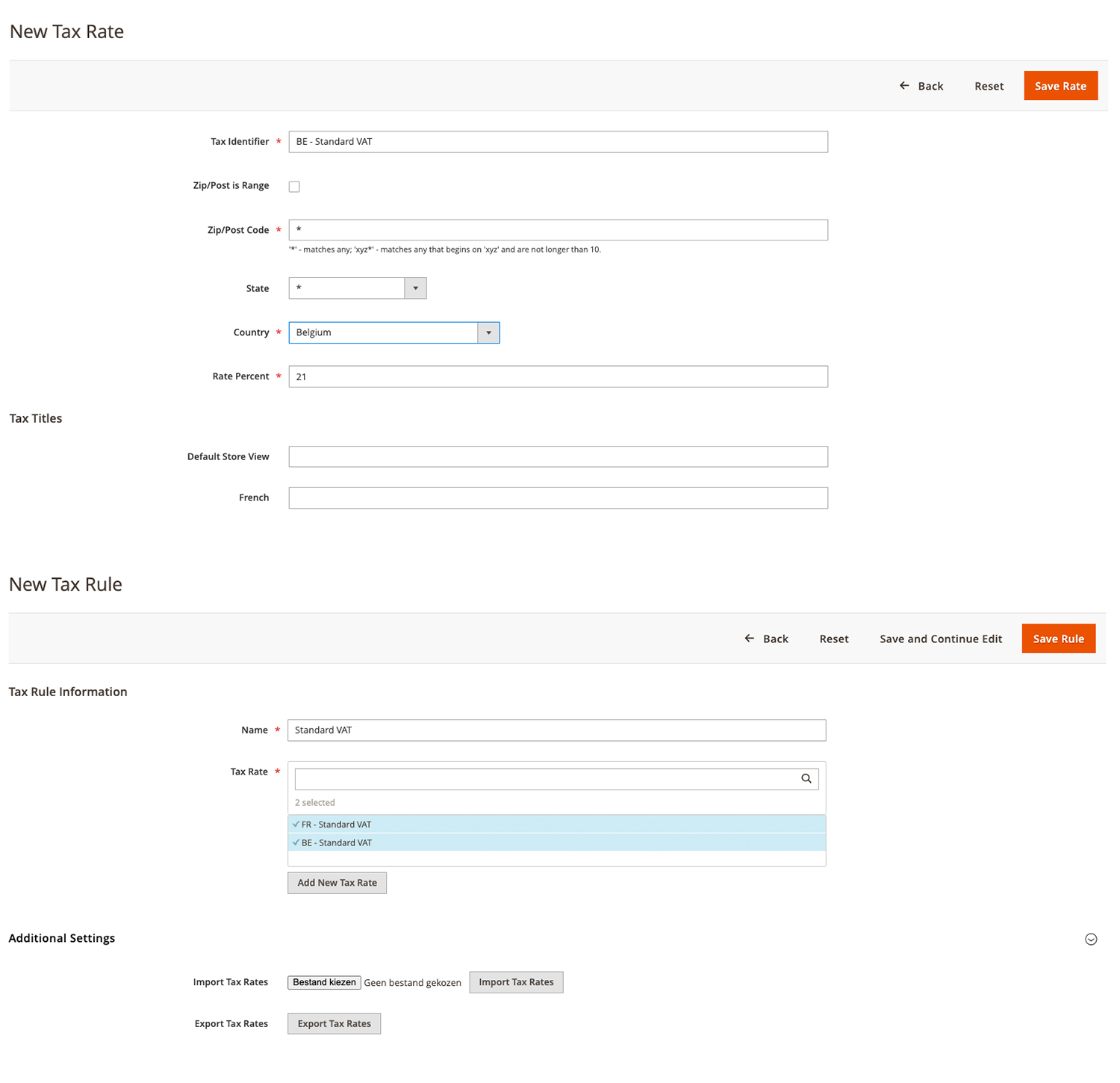

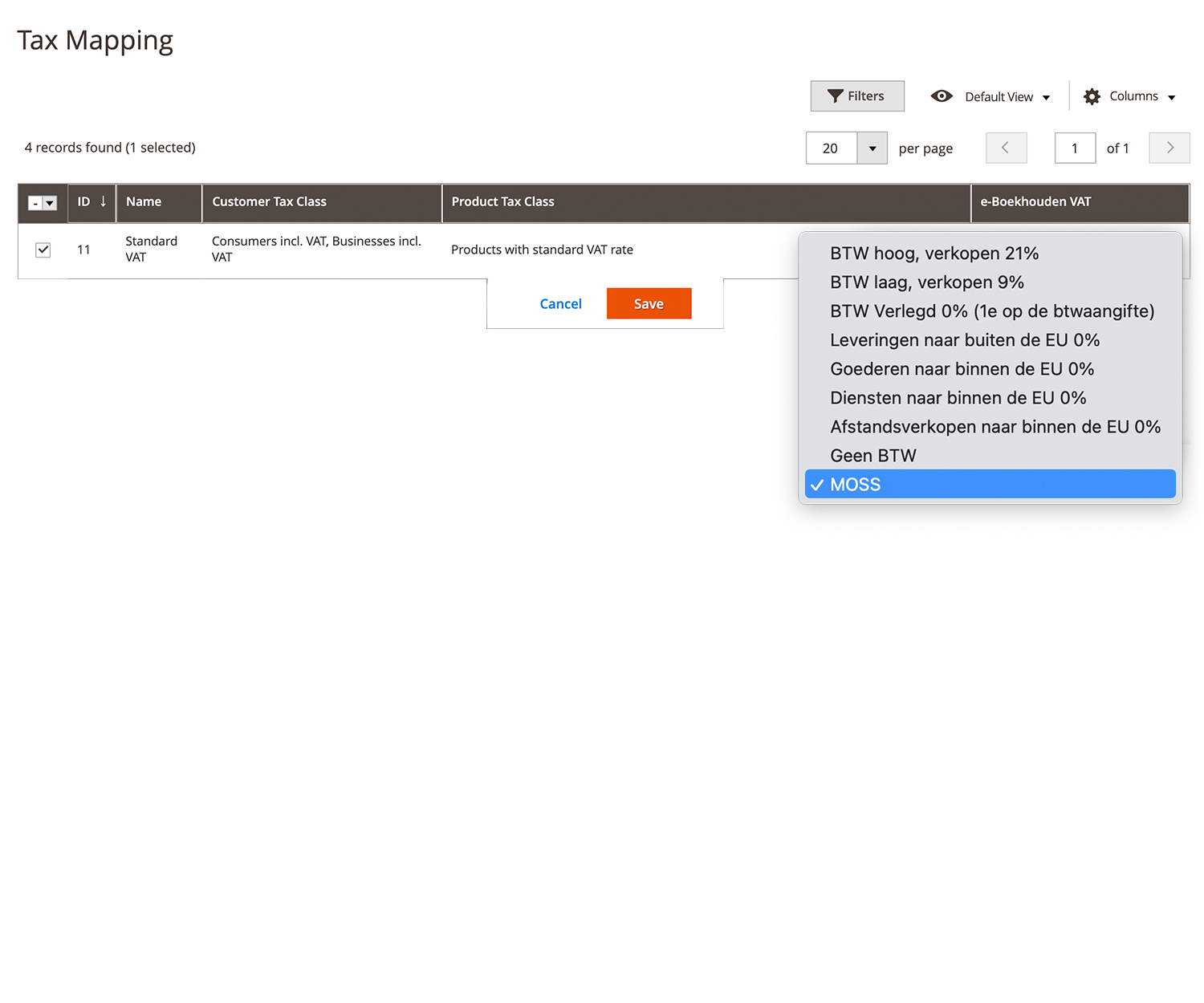

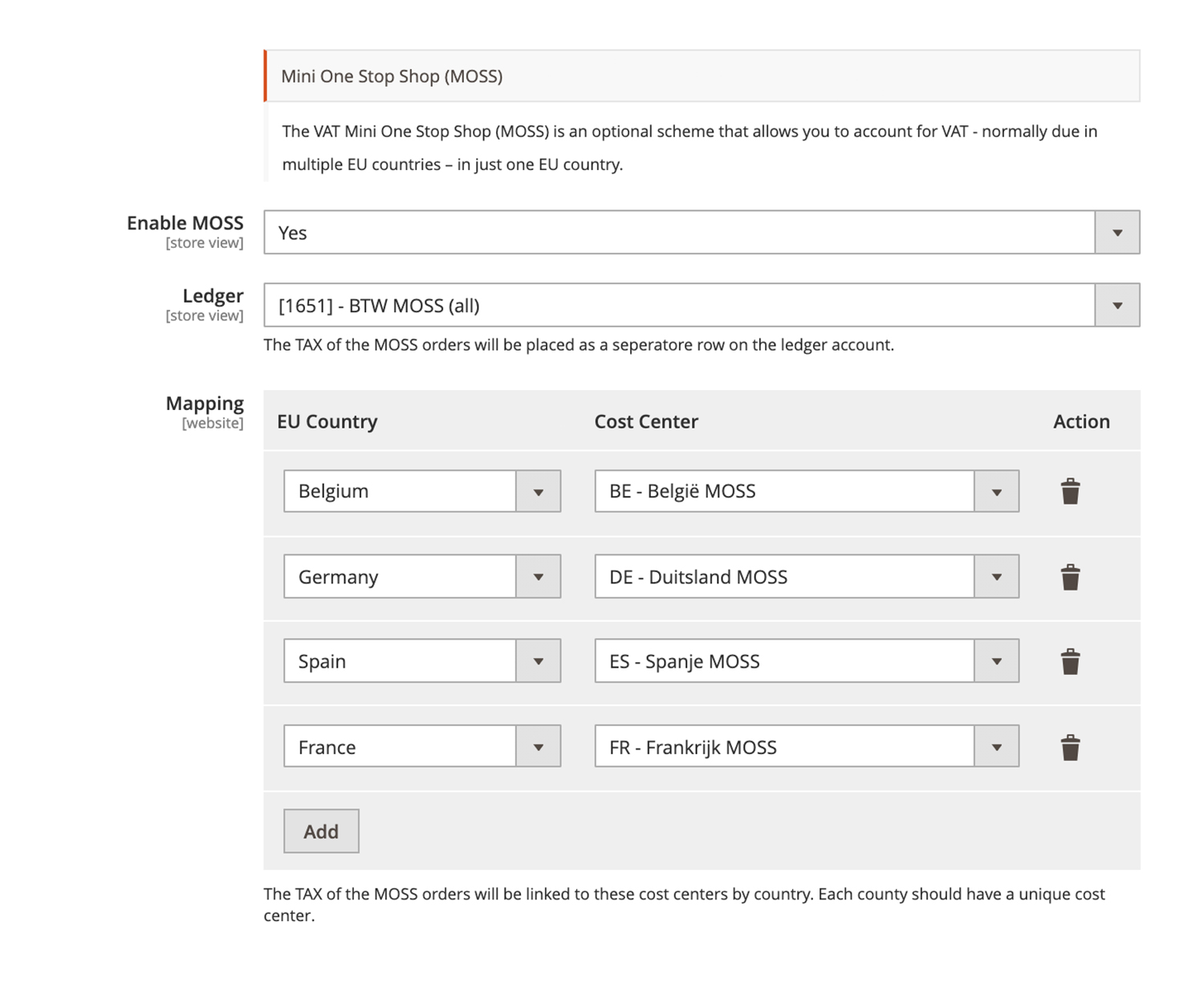

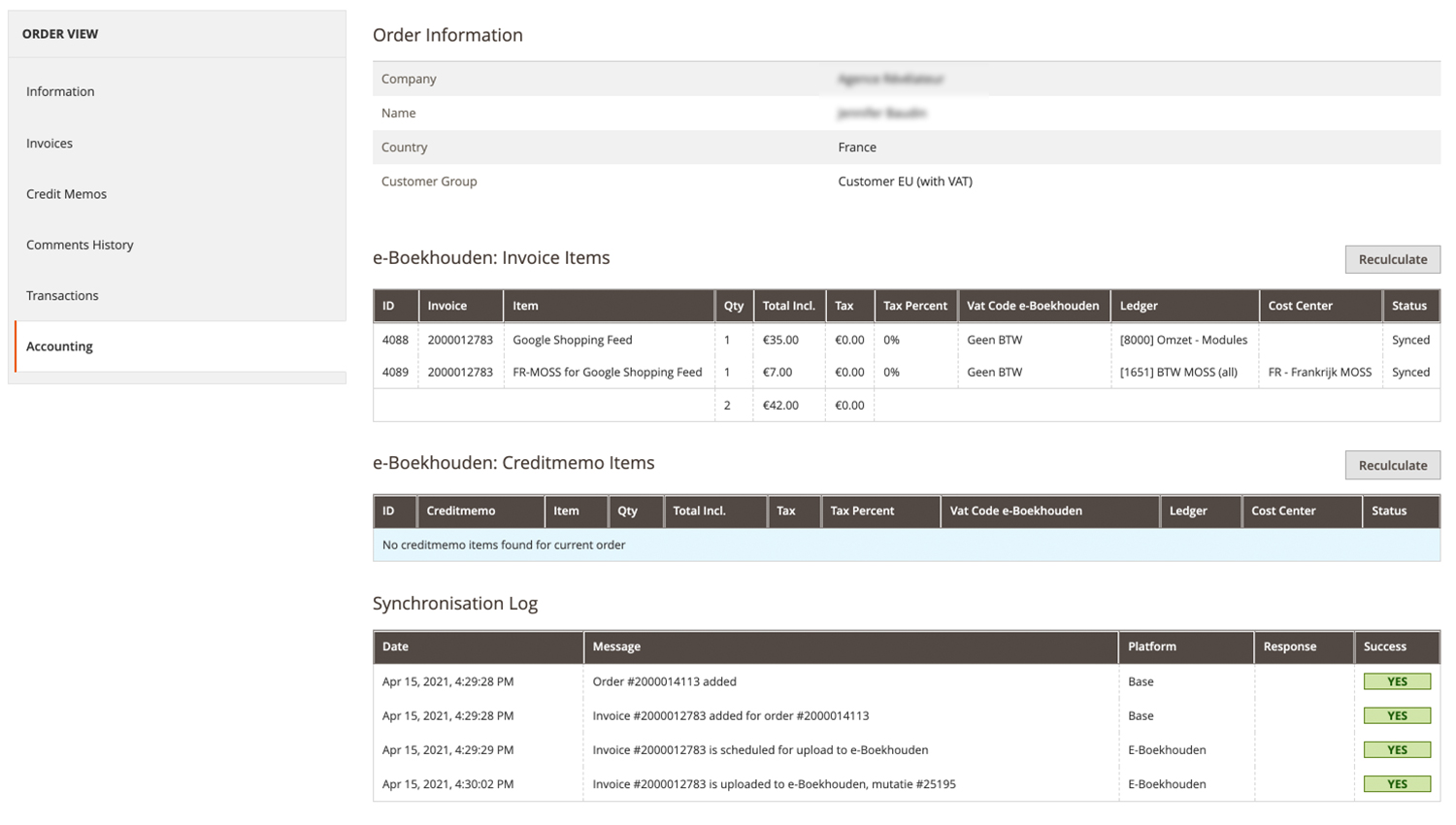

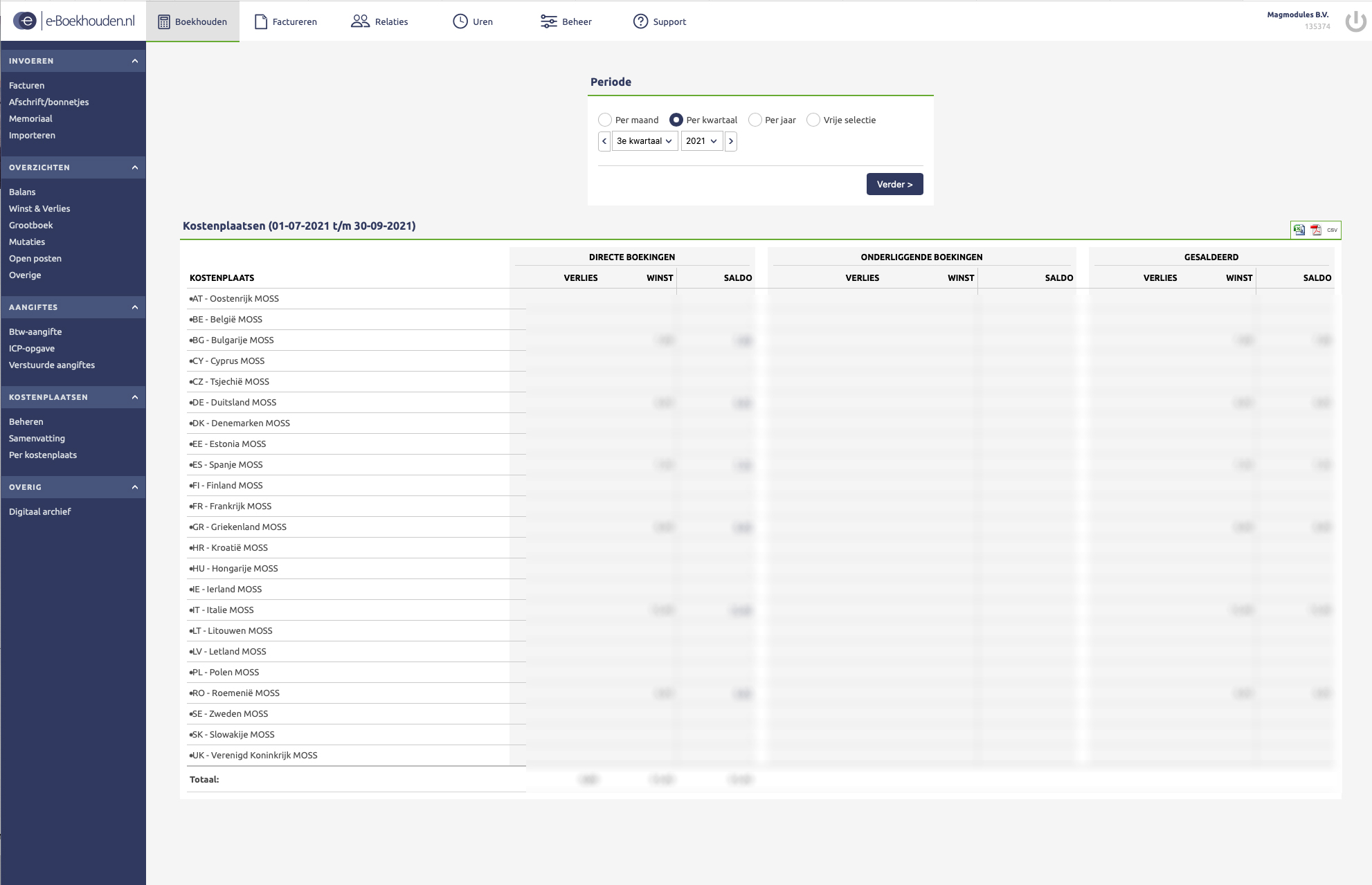

E-boekhouden Boekhoudkoppeling

eKomi Reviews

Facebook Feed and Pixel

Feedback Company Reviews

Google Reviews

Google Shopping Feed

Kiyoh Reviews

MessageBird

NOTYD Payments

Product Review Reminder

Reloadify

Rich Snippets Suite

Shopreview

Sooqr Connect

SwissID

TradeTracker Feed & Pixel

Truelayer Payments

two payments

Vendiro

Verzendkosten op basis van afstand

WebwinkelKeur Reviews

Direct Help

At Magmodules, our support team is here to help you every step of the way.

If you can't find a solution in our Knowledgebase, simply fill in the form below.

We are in the Central European Timezone, and all your details are securely sent to us.

The more information you provide, the better we can assist you. Trust us to guide you through any

challenge and ensure a seamless experience with our products and services.

Support by e-mail

contact@magmodules.eu